Your legacy needs may include:

- Preserving your assets to pass them on to your heirs

- Allocating assets appropriately, especially if you own assets that aren't very liquid

- Allocating assets as you deem fit, and maintaining confidentiality

Let's use an example to see how good planning can help you meet your legacy needs:

Mr. and Mrs. Chen own assets worth approximately RMB20 million, including a business worth RMB8 million. They have two children, but only one wants to take up the business. The couple plans to split their assets equally between their two children when they retire.

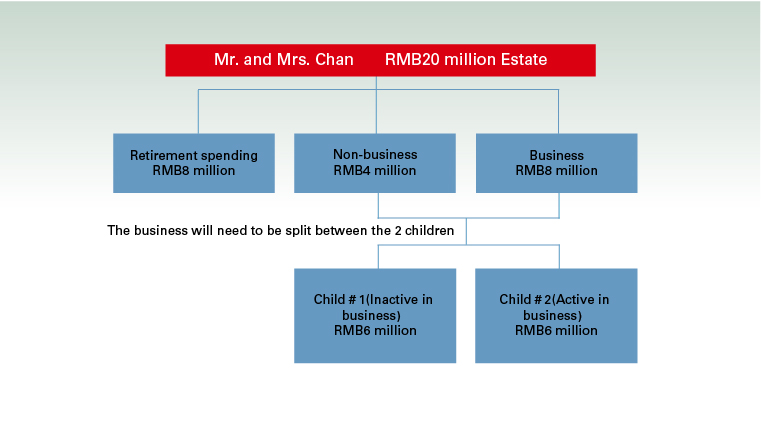

Without legacy planning:

Mr. and Mrs. Chen will have to ensure that their retirement expenses do not exceed RMB8 million to ensure that their children will inherit assets worth RMB12 million.

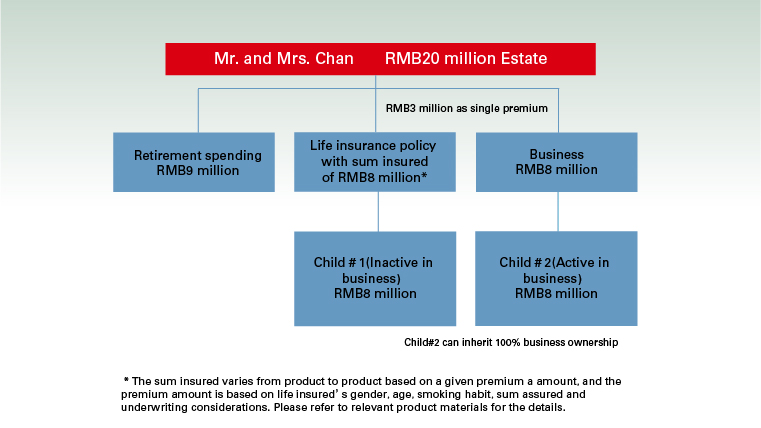

With legacy planning:

Assuming that Mr. and Mrs. Chen’s lump-sum single premium of RMB3 million may be used to buy a life insurance policy worth RMB8 million*. Without having to break up the business, their two children may each inherit assets worth RMB8 million, and Mr. and Mrs. Chen could also increase the retirement expenses available to them to RMB9 million.

* This insurance policy is not an actual representation, and is for illustration purposes only.

Advantages:

- Long-term financial security: Protect your personal and your heirs’ financial needs on a long-term basis

- Increase your liquid assets with insurance planning: Ensure you have ample liquidity for your retirement

- You could choose to allocate any amount exceeding your retirement expenses to your heirs or set it aside for charity

Thus, fully understanding your legacy needs will help you to find the right product.

Contact us

Want to start growing your wealth but not sure where to start? Leave your contact information and we will call you back within 2 working days.

General enquiry on personal financial related service

Please dial the country code of mainland China +86 if you are calling from overseas, Hong Kong SAR, Macau SAR, or Taiwan