7 July 2023

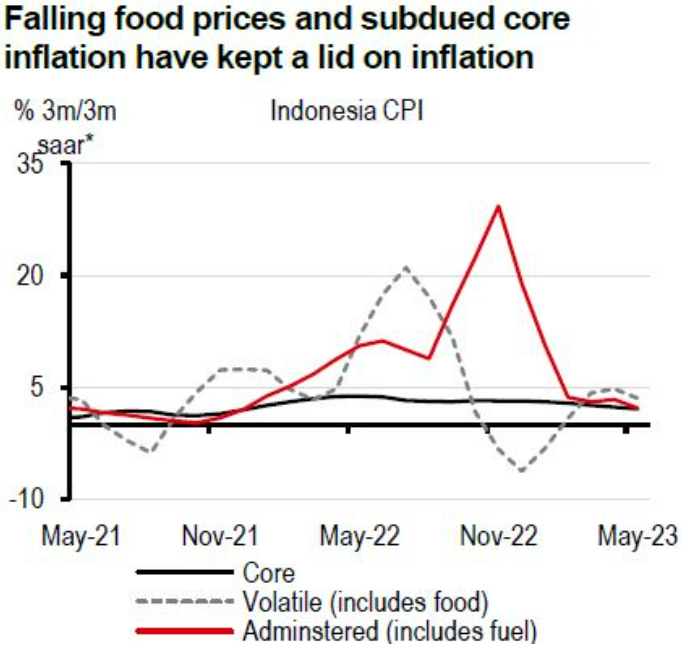

Indonesia continues to impress with its resilience. Inflation has quickly returned to target and the balance of payments remains well anchored. Growth may not be stellar this year, at least not by the country’s own ambitions, but it is even and steady, keeping the economy sailing along. Thailand is still counting on a tourism boom to help it through a trade slump, while in Malaysia foreign direct investment remains a key pillar of growth. The Philippines is still clocking an impressive pace,but inflation has been stickier than elsewhere, and consumers may at some point slow for breath. In Singapore, global headwinds to growth are more keenly felt than elsewhere, but booming services should keep growth at a decent clip. Vietnam is also feeling the chill from weaker exports, but at 5% growth this year, it will still be among the region’s top performers

After becoming Asia’s growth champion, with growth of 8.7% in 2022, Malaysia started 2023 on a surprisingly resilient footing. With strong growth of 5.6% y-o-y in Q1, Malaysia is still among the best growth performers in the region. That said, there is no room for complacency, as downside risks have materialised quickly.

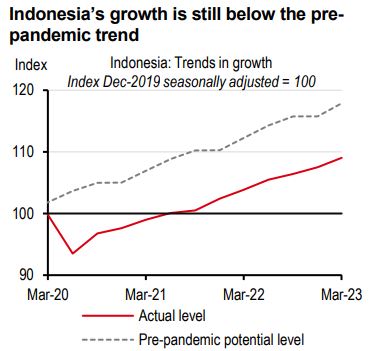

As an exporter of commodities, Indonesia has become an oasis of macro stability against a volatile global backdrop on the back of the high prices for coal and palm oil. However, after rising sharply during the pandemic period, coal prices seem to have peaked for now and have fallen 70% since the start of 2023. Does that mean challenging times ahead?

We believe weak credit growth (as indicated by the recent decline in the credit-to-deposit ratio) may allow Indonesia to maintain macro stability for longer, even as some of the benefits from high coal prices end. One, low credit growth means that much of the banking sector’s excess liquidity remains captive, and does not spill out into the real economy, stoking inflation. Two, low credit growth means higher ‘net’ household saving, keeping the current account balance strong.Three, slow credit growth means that banks don’t have to scramble for liquidity, thereby keeping deposit rates low; in fact, keeping deposit rates lower than bond yields has incentivized domestic bond buying. Tricky times, but the hard work done in the form of policy rate hikes and cutting back on fiscal expenditure may also help preserve macro stability for longer.

Even though growth may slow in the short run, Indonesia’s medium-term growth potential is strong. On the back of careful policy steps, Indonesia is climbing up the metals value chain: from ores to processed metals, all the way to electric vehicles (EVs). Growth could be 0.5ppt higher and the current account deficit 2% of GDP lower by 2028, alongside greater monetary policy freedom.

After becoming Asia’s growth champion, with growth of 8.7% in 2022, Malaysia started 2023 on a surprisingly resilient footing. With strong growth of 5.6% y-o-y in Q1, Malaysia is still among the best growth performers in the region. That said, there is no room for complacency, as downside risks have materialised quickly.

Crucially, the economic resilience is partly thanks to Malaysia’s relatively robust trade sector,defying a notable global trade slowdown. As an economy with a well-diversified export base of commodities and a heavy exposure to electronics manufacturing, Malaysia’s trade remains one of Asia’s outperformers. That said, Malaysia is not insulated from intensifying trade headwinds,especially coupled with unfavourable base effects. In fact, Malaysia saw the first decline in 31 months in its March exports from a year ago, and suffered from a double-digit decline in April. With the exception of petroleum products, weakness has been broad-based. Despite China’s re-opening, Malaysia’s exports to China in Q1 2023 also slumped by double digits, a pace similar to ASEAN peers. The main drag comes from falling machinery shipments, which are closely related to the subdued global electronics cycle.

Despite cyclical trade challenges, Malaysia remains in a favourable position to continue attracting quality foreign direct investment (FDI). High-frequency data show that FDI approvals accounted for 4% of GDP, well ahead of ASEAN peers. In particular, China’s FDI footprint has expanded rapidly in Malaysia. In a recent visit by Prime Minister Anwar Ibrahim to China, Malaysia has secured a record MYR170bn (USD38bn) of FDI commitments across various sectors, including energy and automotive industries. This will likely translate into future production, helping Malaysia gain increasing market shares.

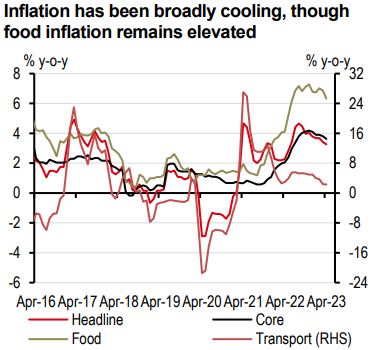

All in all, we upgrade our growth forecast to 4.3% for 2023 (from 4.0% previously), amid the outperformance in Q1 2023. That said, downside risks will likely intensify in 2H 2023,warranting a close watch. Meanwhile, Malaysia continues to see benign inflation in 2023, thanks to generous subsidies. Encouragingly, inflation has been consistently cooling, with broad-based deceleration. That said, the pace of cooling core inflation is only gradual, partly due to the stillrecovering labour market. Indeed, the labour market has not fully reached pre-pandemic levels yet. In addition, the risk from El Niño could push food inflation higher later this year.

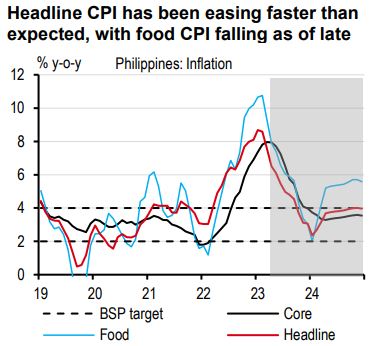

The inflation narrative finally took its much-awaited turn. Headline CPI has shifted gears and is on its way back to the Bangko Sentral ng Pilipinas’s (BSP) target band of 2-4%. What led to this shift was the authorities rebalancing their pursuit of food self-sufficiency: the government allowed the large and urgent importation of specific food items to augment supply and put a cap on prices. As a result, food CPI (seasonally adjusted) fell from a month ago for two months in a row after 12 straight months of increases. With the inflation outlook more benign, the BSP took a breather and paused its tightening cycle after shocking the market with the most aggressive series of rate hikes seen in ASEAN.

Although upward price pressures are easing, high inflation and interest rates should have put a dent on consumption and investment – however, so far, they haven’t; the Philippine economy has been exhibiting a display of resilience, growing above market expectations for three consecutive quarters. While goods exports deteriorated significantly in Q1 2023, overall GDP growth still matched the historical trend at 6.4% y-o-y. The main driver was final domestic demand, which marched against the headwinds and even accelerated from a year ago.

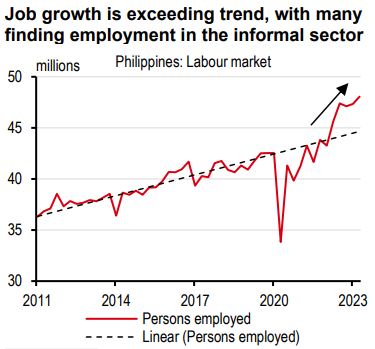

The resiliency displayed was due to labour, both domestic and abroad. To get by in these challenging times, a bigger proportion of households might have decided to join the labour force. This was evident in job growth exceeding the demographic trend, with many finding employment in the informal sector. Although these jobs are usually low-income ones, the boom in employment helped augment household incomes to make up for higher prices. Remittances from overseas workers also continued to be a formidable and reliable support for household consumption and investment. In PHP terms, remittances grew more than 10% y-o-y in Q1 2023, which more than offset the 8.3% rise in prices.

With Q1 growth coming in higher than expected, we raised our full-year GDP forecast for 2023 to 5.3% (from 4.8% previously). The new forecast still suggests that growth is expected to slow in 2023 (from 7.6% in 2022); however, with all things considered, it is still a punchy number, given the headwinds facing the economy. With growth resilient, there are still upside risks to inflation that the BSP will look out for. As such, we expect the BSP to maintain a tight monetary stance and keep rates steady at 6.25%. Once inflation is within the target range, we expect the BSP to begin cutting its policy rate only after the US Federal Reserve delivers rate cut. As such, the BSP will probably loosen its monetary policy by 25bp to 6.00% in Q3 2024 and deliver another 25bp cut, bringing its policy rate to 5.75% in Q4 2024.

As one of the first Asian economies to recover from the pandemic, Singapore’s growth looks set to slow in 2023. The latest Q1 2023 GDP print, which registered a small contraction of 0.4% on a seasonally adjusted basis from a quarter ago, is a clear reflection of the mounting headwinds Singapore has been facing.

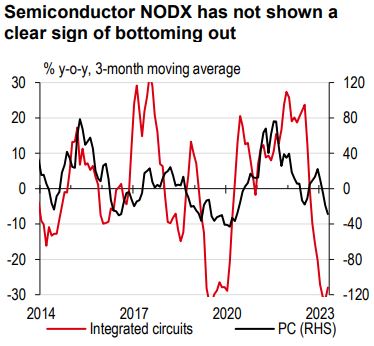

It goes without saying that a sharply cooling global trade cycle remains the biggest drag to Singapore’s growth. On a three-month moving average basis, Singapore’s non-oil domestic exports (NODX) recently plunged over 10% y-o-y, with broad-based weakness. In particular, the electronics NODX remains in the doldrums, a result of both a price correction and stumbling orders. Despite recent market optimism on big themes, including AI, tech-heavy economies are not out of the woods. In addition, Singapore’s petrochemical shipments, 25% of which head to China, continue to suffer from double-digit declines. This suggests that China’s re-opening has not translated into a rebound of Singapore’s trade. In fact,ASEAN’s exports are more closely related to China’s industrial cycle, which itself is not immune to a cooling global trade cycle either.

That said, the ripples will mostly come from travel and tourism sectors. Singapore is well positioned to lead the region with a swift recovery and has welcomed over one million visitors for two consecutive months, reaching 70% of 2019’s level. While the return of Chinese tourists is only back to 30% of the equivalent level, Singapore is, nonetheless, the champion in restoring direct flights with China. Albeit still low, flights have jumped to half of the pandemic’s level, well ahead of peers in ASEAN (30-40%), Europe (30%) and the US (5%). This paves the way for an acceleration in Chinese tourists in the coming months, supporting Singapore’s services sectors.

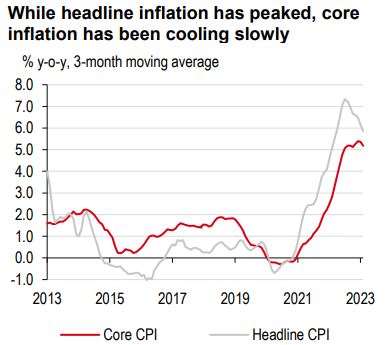

All in all, we trim Singapore’s 2023 growth forecast to 1.8% (from 2.1% previously),accounting for prolonged trade weakness. That said, an improvement in travel sectors should prevent a recession. Singapore continues to face high inflation. While headline inflation moderated sharply from its peak last September, core inflation has been cooling only gradually, still hovering at 5.0% y-o-y, well above the Monetary Authority of Singapore’s (MAS) comfort zone. Part of the broad-based price pressures is due to a still-tight labour market. While cooling inflation is the broad trend, we expect the pace of moderation to be gradual, with some meaningful deceleration only starting to materialise from 2H 2023. As a result, we maintain our core CPI inflation forecast at 4.1% for 2023.

Despite the landslide win by the opposition parties in the 2023 Thai general election, there is still no clear government in sight. The unelected Senate still has considerable sway in choosing who the next prime minister will be, resulting in uncertainty in the policy outlook. Adding to this is the risk of the political landscape changing in a span of just one year; come May 2024, the Senate loses its power to vote for the prime minister.

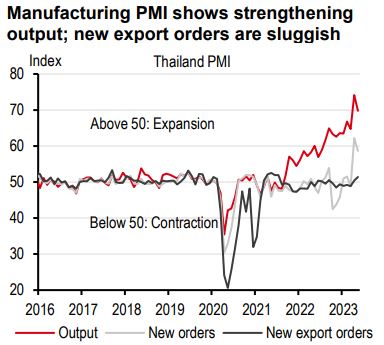

Nevertheless, we remain confident that Thailand’s growth outlook in the next two years remains largely intact. So far, the rate of tourist arrivals is on track to reach our 29.5 million forecast and there is still a lot of room to recover with the number of mainland Chinese visitors still less than half of what it used to be. And this boom in tourism has been a launching pad for domestic consumption due to the direct and indirect jobs generated by the sector. In fact, the number of jobs in Q1 2023 was the highest ever recorded, bucking the demographic challenges the economy has been so well-known for. And leading indicators have been supportive of such a bullish view. The recent manufacturing PMIs show strength, supported by robust domestic demand and manufacturing output. Likewise, consumption is supported by benign inflation, which significantly eased to 0.5% y-o-y in May from 2.7% in April.

Merchandise exports are deteriorating as of late, but we think the recovery in tourism and its knock-on effect on consumption will more than offset the drag. After growth of 2.6% in 2023, the Thai economy is expected to grow at 3.7% in 2023. Subsequently, growth should be more favourable in 2024 (our full-year forecast is 4.1%) once global trade finally makes a turn and tourism continues to recover.

We think this strong outlook in growth was the main reason why the Bank of Thailand (BoT) signalled to push rates further in the last rate-setting meeting. However, since inflation shattered expectations by falling below the BoT’s 1-3% target band in May, we now expect the BoT to pause its tightening cycle earlier, at 2.00% (previously 2.25%) in Q3 2023. With Thailand’s growth narrative still bright in 2024, we expect the BoT to hold its monetary stance and it will unlikely make any cuts before 2025.

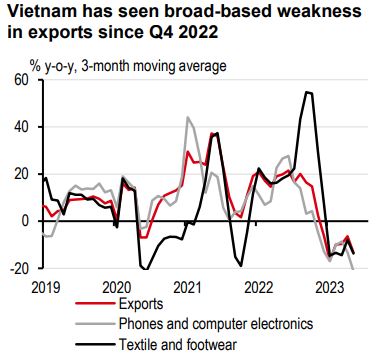

After seeing sharply slowing growth of only 4.1% y-o-y in Q2 2023, Vietnam continues to brace for strong headwinds. Despite no further deterioration, based on high frequency indicators, there is also no clear sign that Vietnam’s economy is bottoming out amid increasing challenges. Sluggish external data remain the biggest downside risks to growth. Exports continued to plunge by around 12% y-o-y in Q2 2023, after a similar double-digit fall in Q1. After all, lingering broad-based export weakness continues to weigh on Vietnam’s growth prospects, with none of the major categories showing signs of a meaningful rebound. The main drag came from shipments to the US, which have strikingly declined by 20% y-o-y recently.

That said, it is not all a gloomy picture. Vietnam’s services sector remains a bright spot,partially shielding the economy from external weakness. However, there is a clear divergence between big ticket items, including automotive sales and tourism-related services. Encouragingly, Vietnam continues to see a positive influx of tourists. Vietnam has welcomed close to one million tourists per month lately, around 80% of 2019’s monthly level in June. In particular, tourists from mainland China have recovered to 45% of the equivalent level – though still slow, the progress is ongoing. With gradual flight restorations and further easing of visa restrictions, which have been recently approved by the National Assembly, Vietnam will likely see a punchier boost from tourism in Q4 2023, though later than our original estimates.

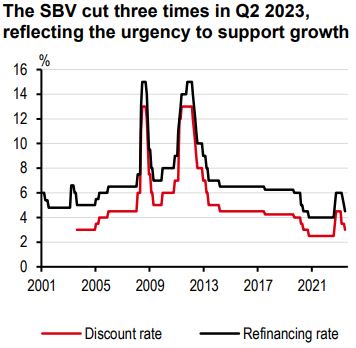

All things considered, we have trimmed our 2023 growth forecast slightly to 5.0% (from 5.2% previously), considering a protracted trade downturn. Vietnam’s inflation has been consistently cooling, falling to 2.0% y-o-y in June. Despite a one-off electricity price hike, easing energy prices more than offset some upside pressures. As such, we have lowered our 2023 inflation forecast to 2.6% for both 2023 and 2024. This will open more space for the State Bank of Vietnam (SBV) to introduce support.

Additional disclosures

1. This report is dated as at 06 July 2023

2. All market data included in this report are dated as at close 05 July 2023, unless a different date and/or a specific time of day is indicated in the report.

3. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

4. You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document is distributed by HSBC Continental Europe, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank (Taiwan) Limited, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (200801006421 (807705-X)), The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank Middle East Limited, HSBC UK Bank plc, HSBC Bank plc, Jersey Branch, and HSBC Bank plc, Guernsey Branch, HSBC Private Bank (Suisse) SA, HSBC Private Bank (Suisse) SA DIFC Branch, HSBC Private Bank Suisse SA, South Africa Representative Office, HSBC Financial Services (Lebanon) SAL, HSBC Private banking (Luxembourg) SA and The Hongkong and Shanghai Banking Corporation Limited (collectively, the “Distributors”) to their respective clients. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice. HBAP and the Distributors are not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HBAP and the Distributors give no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document. This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You should not use or rely on this document in making any investment decision. HBAP and the Distributors are not responsible for such use or reliance by you. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document. You should not reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to any jurisdiction where its distribution is unlawful.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/business. However, the Bank disclaims any guaranty on the management or operation performance of the trust business.

The following statement is only applicable to by HSBC Bank Australia with regard to how the publication is distributed to its customers: This document is distributed by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL/ACL 232595 (HBAU). HBAP has a Sydney Branch ARBN 117 925 970 AFSL 301737.The statements contained in this document are general in nature and do not constitute investment research or a recommendation, or a statement of opinion (financial product advice) to buy or sell investments. This document has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the document you should consider its appropriateness to you, with regard to your objectives, financial situation, and needs.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

Mainland China

In mainland China, this document is distributed by HSBC Bank (China) Company Limited (“HBCN”) and HSBC FinTech Services (Shanghai) Company Limited to its customers for general reference only. This document is not, and is not intended to be, for the purpose of providing securities and futures investment advisory services or financial information services, or promoting or selling any wealth management product. This document provides all content and information solely on an "as-is/as-available" basis. You SHOULD consult your own professional adviser if you have any questions regarding this document.

The material contained in this document is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HSBC India does not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Investments are subject to market risk, read all investment related documents carefully.

© Copyright 2025. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Important information on sustainable investing

“Sustainable investments” include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors (collectively, “sustainability”) to varying degrees. Certain instruments we include within this category may be in the process of changing to deliver sustainability outcomes.

There is no guarantee that sustainable investments will produce returns similar to those which don’t consider these factors. Sustainable investments may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for sustainable investments, or the impact of sustainable investments (“sustainability impact”). Sustainable investment and sustainability impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and/or reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of sustainability impact will be achieved.

Sustainable investing is an evolving area and new regulations may come into effect which may affect how an investment is categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.