6 February 2026

Key takeaways

Markets can fluctuate depending on the news flow or expectations on valuations and corporate earnings. It is important to remember that volatility is to be expected from time to time in financial markets.

Short-term volatility can occur at any time, but they do not necessarily derail the long-term growth in stock markets. Historically, significant recoveries occur following major setbacks including economic downturns and geopolitical events.

While headline-grabbing news can affect short-term market sentiment and lead to reductions in asset valuations, share prices should ultimately be driven by fundamentals over the long run. Therefore, investors should avoid panic selling during volatile periods, to avoid missing out on any potential market recovery.

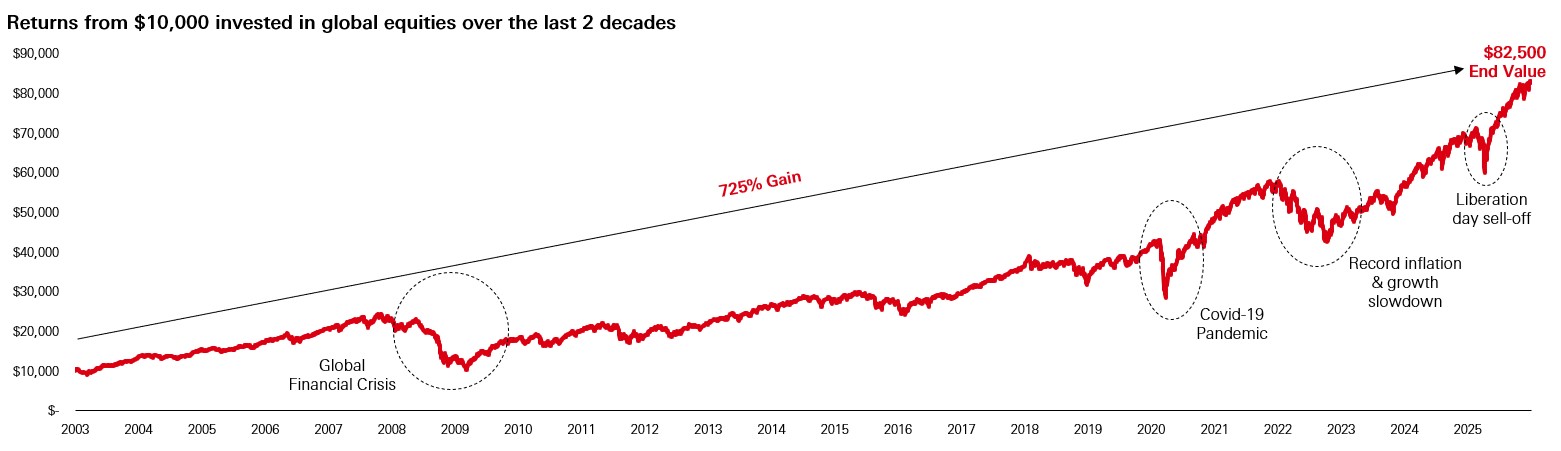

Chart 1: Returns from $10,000 invested in global stocks over the last 2 decades

Past performance is no guarantee of future returns.

Source: Bloomberg, HSBC Asset Management as at 31 December 2025. MSCI ACWI Net Return index.

When markets get rocky, it is tempting to exit the market to avoid further losses. However, those who focus on short-term market volatility may end up buying high and selling low. History has shown that financial markets go up in the long run despite short-term fluctuations. Though markets do not always follow the same recovery paths, periods after corrections are often critical times to be exposed to the markets. Staying invested for longer periods tends to offer higher return potential.

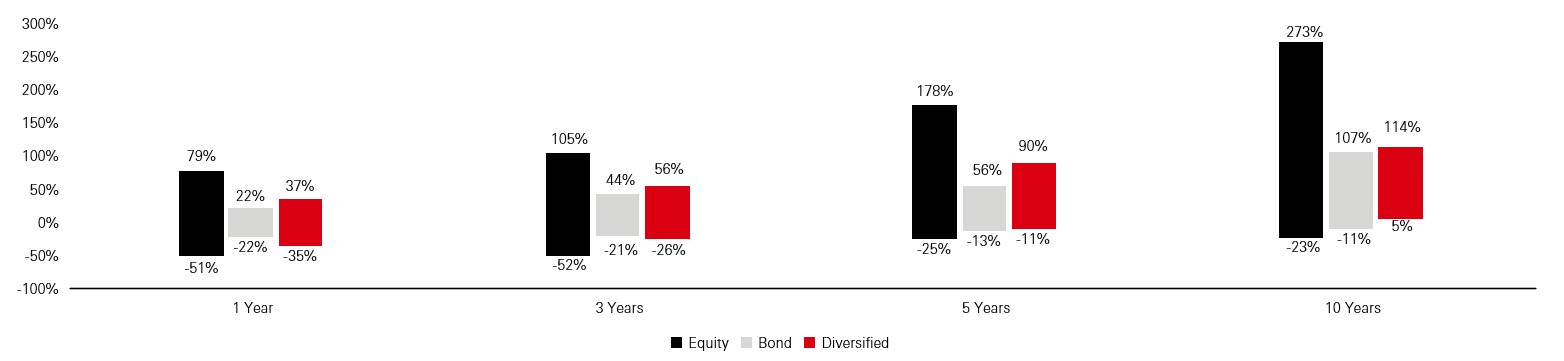

For example, the 1-year bar chart (far left) shows that performance of global equities over any 1-year period between 1999 and 2025 ranged between -51% and 79%. For any 10-year period, returns ranged between -23% and 273%. The diversified approach is the only one that generated positive returns over any 10-year period!

Chart 2: Range of returns over different time frames since 1999

Currency: USD. Source: Bloomberg, HSBC Asset Management, as at 31 December 2025. Indices used: Equities – MSCI AC World Total Return Index. Bonds – Bloomberg Global-Aggregate Total Return Index Value Unhedged USD. 'Diversified’ is a representative, balanced asset allocation across global equities, bonds and alternatives. Bond indices are hedged. Equities are unhedged. Past performance is no guarantee of future returns.

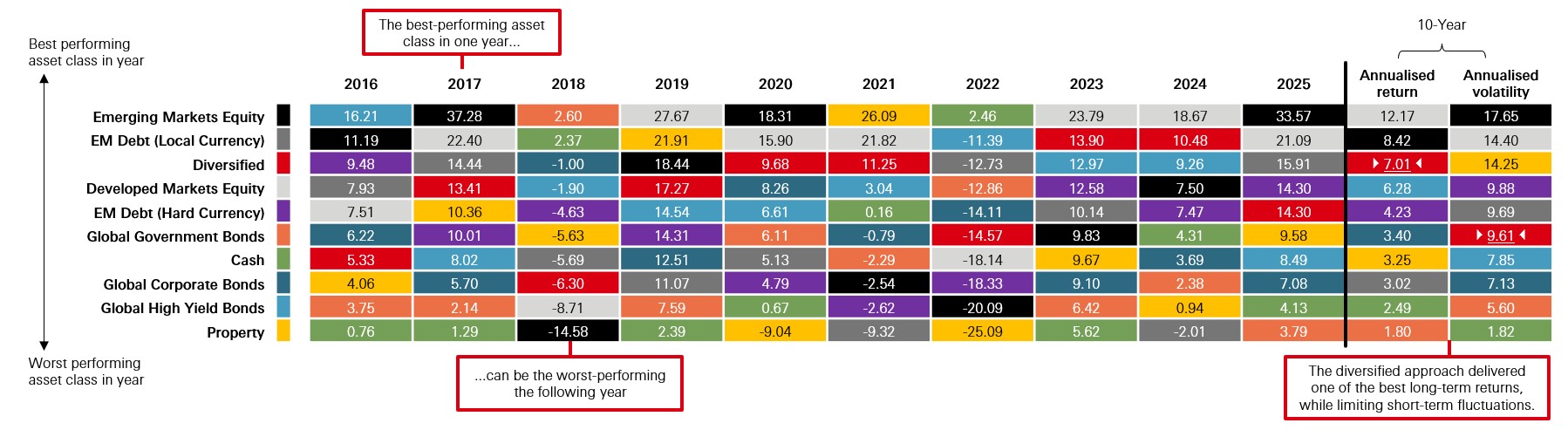

Diversification means investing in various asset classes at the same time, allowing your investment to be less exposed to large fluctuations. Different asset classes often perform differently under various market conditions.

By combining assets with different characteristics, the risks and performance of different investments are combined, thus lowering overall portfolio risk. That means, a lower return in one type of asset may be compensated by a gain in another.

Chart 3: The performance of each asset class varies over time

Source: Morningstar, HSBC Asset Management, data to December 2025. All returns in USD, total return. Indices used: DM Equities: MSCI World Index; EM Equities: MSCI Emerging Market Equity; EMD Local currency: Bloomberg EM Local Currency Government Diversified; EMD Hard currency: ICE Bank of America Merrill Lynch Emerging Market Bond Index; Global Corporate Bond: Bloomberg Barclays Global Aggregate Corporate Bond Index; Global High Yield Bond: ICE Bank of America Merrill Lynch Global High Yield; Global Government Bond: FTSE World Government Bond Index; Property: FTSE EPPRA/NAREIT Developed Property Index; Cash: ICE LIBOR 3 Month; Diversified: 'Diversified' performance was calculated using a representative, moderate-risk asset allocation to all of the stated indices. Bond indices are hedged. Equities are unhedged. Past performance is no guarantee of future returns.

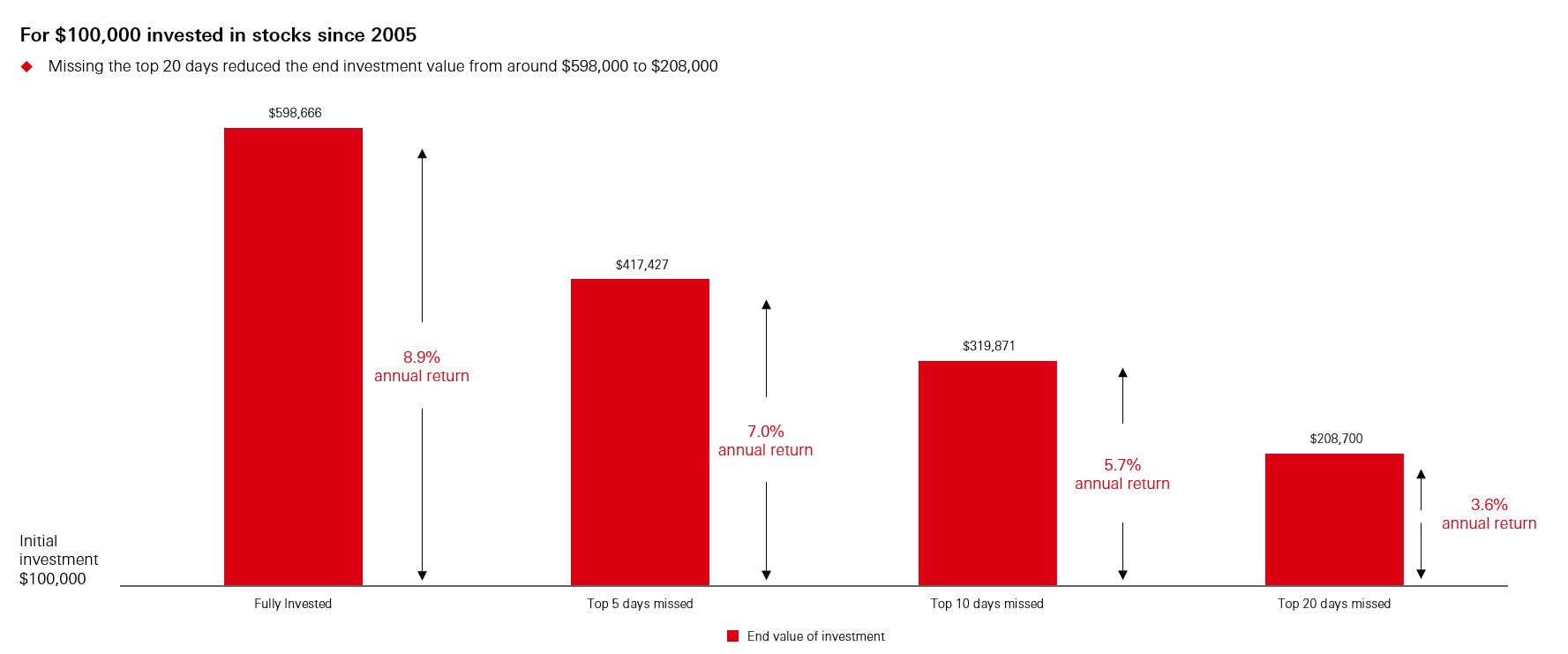

Don’t be passive in the face of market declines. When market sentiment is low, valuations tend to be driven down which provides investment opportunities In rising markets, people tend to invest as they chase returns, while in declining markets people tend to sell. When investors overreact to market conditions, they may miss out on some of the best-performing days.

Though no one can predict market movements, the times when ‘everyone’ is overwhelmingly negative often turns out to be the best times to invest.

Chart 4: Missed opportunities could be costly

Source: Bloomberg, HSBC Asset Management. Returns are for developed market stocks - MSCI World Daily Total Return Gross World Index, as at 31 December 2025. Past performance is no guarantee of future performance. The figures are purely hypothetical

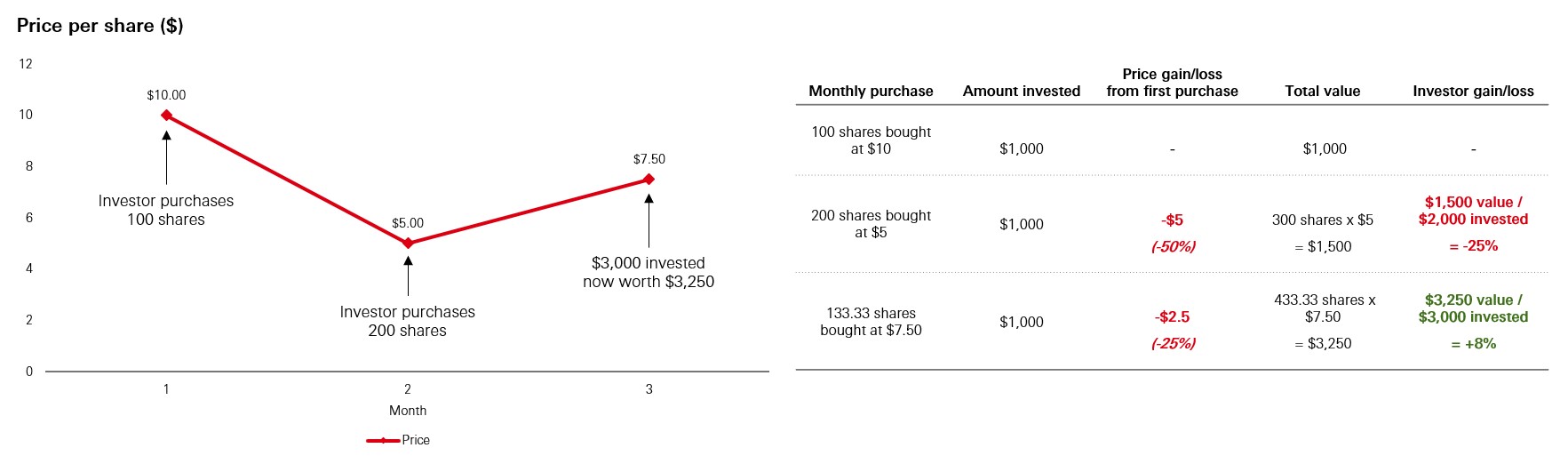

Investing regularly means continuous investment regardless of what is happening in the markets. When investors make fixed regular investments, they buy more units when prices are low and less when prices are high. This will smooth out the investment journey and average out the price at which units are bought (Chart 5), thus reducing the risk of investing a lump sum at the wrong time, particularly amid market volatility. The longer the time frame for investment the better, because it allows more time for investments to grow via (the compounding effect).

As example below,Even though the investor buys $1,000 worth of shares at both a price of $10 and $5 per share, the outcome is a gain. This is because investing a fixed dollar amount means buying double the number of shares at the lower $5 price versus the original amount purchased at $10.

Chart 5: Regular investing helps smooth out the effects and fear of market movements

Source: HSBC Asset Management. For illustrative purposes only and does not relate to any investments. The figures are purely hypothetical. Past performance is no guarantee of future returns.