16 Dec 2024

Air travel is likely to be disrupted by the impact of climate change as more severe winter storms, hotter summer heatwaves and stronger jet streams impact flight operations. In this report, we discuss how aviation-related businesses, including airlines, airports and aircraft manufacturers, need to build resilience through investing in adaptation methods to reduce the incidence of flight delays and cancellations, and the resulting human and financial costs.

Source: What causes air turbulence and is the climate crisis making it worse?, Guardian, 21 May 2024, Johnson E. P., Aircraft deicer: Recycling can cut carbon emissions in half, January 2012, Flight Aware.

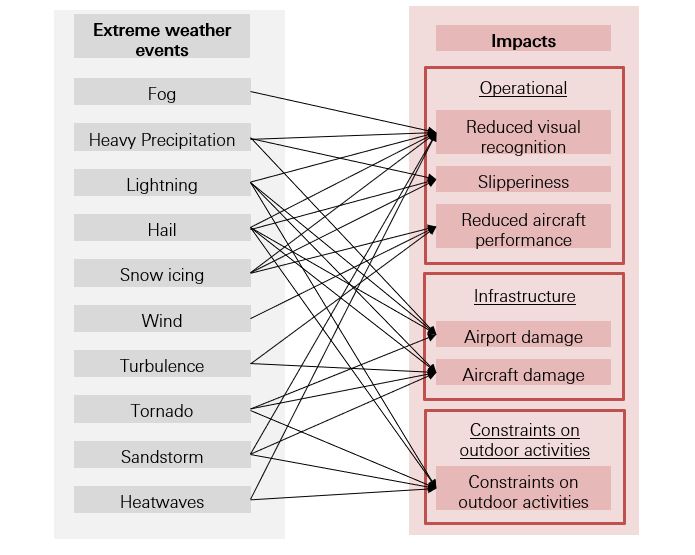

There has been much public discussion about how the aviation industry has intensified climate change, but relatively less that examines the impact of climate change on the aviation industry. For example, some extreme weather events have become more frequent and severe, which could lead to air travel disruptions. Aviation has been, and will need to be, more prepared for the potential changes brought about by climate change.

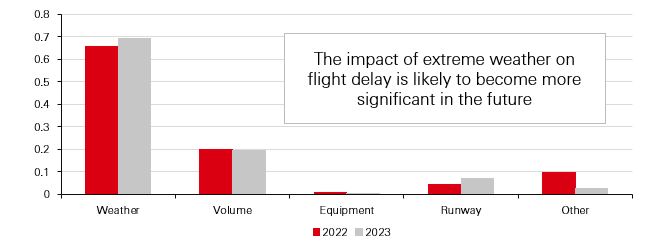

Blizzards, winter storms, snow and reduced visibility are predicted to become more intense, despite shorter winters and rising temperatures[@why-esg-matters-06-01]. A recent example was the January 2024 Arctic blast that caused thousands of flight cancellations and more than 16,000 flight delays in the US. That said, we think extreme weather events are likely to cause more disruptions to air travel than continuous winter weather conditions in the future.

Carrier flight delays at departure by cause in the United States

De-icing infrastructure

Climate change could also increase the incidence of icy conditions, as warmer air, holding more moisture, brings higher levels of rain and snow[@why-esg-matters-06-02]. Indeed, small amounts of frost and ice on a plane can interfere with takeoff, so we think airlines will need to strengthen their winter infrastructure, including de-icing equipment, workers with de-icing training and aircraft with efficient de-icing technology, to ensure smooth operations. However, these could lead to higher operating costs during the winter and an increase in the financial costs of flight delays.

Airports that aren’t usually affected by icing conditions would also need to be prepared for extreme weather events by upgrading their de-icing infrastructure. A disrupted polar vortex causes cold air to move south and brings unusually cold air to mid-latitudes, while a stable polar vortex would contain the cold air around the North Pole. With climate change likely to result in more frequent polar vortex disruptions[@why-esg-matters-06-03], airports would need to prepare for extreme winter conditions in mid-latitude areas, such as Texas and the Gulf Coast[@why-esg-matters-06-04].

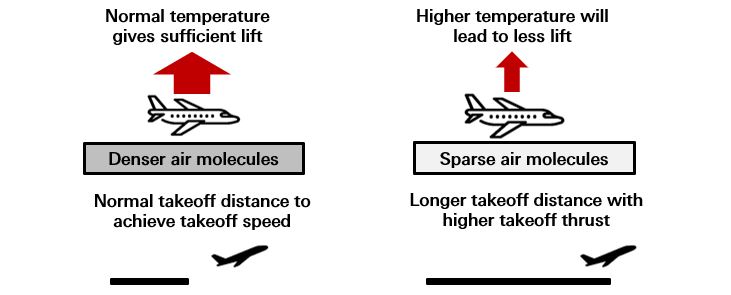

Heatwaves and taking off

Heatwaves can also impact flight operations, including the lift an aircraft can generate. Air expands when it heats up, meaning its density becomes lower, affecting lift. In general, every lift reduces by 1% for every 3°C increase in temperature. Planes, therefore, would need longer to reach speeds that can generate sufficient lift for takeoff. However, there are several ways to overcome this, including reducing the weight of the plane or extending the runway.

The impact of hot air on flying is, therefore, more significant at airports with short runways. We think airports that fall into this category might need to upgrade their infrastructure (i.e., longer runway distance) to cope with the increase in the number of days with extreme heat. However, some airports have no space to expand due to geographical constraints or dense neighbourhoods in the vicinity. These airports might be disrupted the most.

The impact of air temperature on aircraft lift and take-off

Will there be more airports operating 24/7?

Aircraft manufacturers have been looking for ways to make planes lighter and more efficient during hot days. However, further gains are likely to require the invention of revolutionary new materials[@why-esg-matters-06-05]. Quite simply, the most effective way to avoid the heat is to take early morning and late-night flights, as these are less likely to be affected by the heat.

Another advantage of scheduling more flights during the cooler hours of the day is to avoid airport workers’ exposure to extreme heat. The temperature of taxiways and runways is usually much hotter than the atmosphere around the airport. Airport operators would need to be aware of protections and guidance provided for the workers during hot days.

Jet stream and cruising

Climate change will lead to faster jet stream winds, the strongest projected to speed up by about 2% for every 1°C of global warming[@why-esg-matters-06-06] and have multiple implications for flying.

Stronger jet streams can speed up flights when travelling in the same direction, as the planes get an additional push from the wind, which increases their relative ground speed. However, the four main jet streams only travel from west to east, so planes flying in the opposite direction are more likely to face stronger headwinds, causing more delays and in some extreme cases, additional or unexpected refuelling stops.

The risk of encountering clear-air turbulence (CAT) - turbulence with lower moisture content that is less detectable by conventional radar - also rises with stronger jet streams. Research shows that changes to the jet stream due to global warming will increase CAT by 113% over North America and as much as 181% over the North Atlantic by 2030 to 2050[@why-esg-matters-06-07], and that turbulence may cost US airlines as much as USD500m annually[@why-esg-matters-06-08].

Severe turbulence may cause substantial aircraft damage, and we think compensation claims from injured passengers, as well as associated maintenance and repair costs, could grow with more incidents. Advanced development of weather detection and prediction systems is important for pilots to better understand CAT and to enhance the safety and comfort of flying. This can also reduce fuel used to navigate around turbulent air, lowering operating costs.

The aviation industry is vulnerable to the increase in the intensity of extreme weather events, which could become increasingly costly. The industry needs to actively assess potential impacts and take relevant actions to adapt to climate change. In our view, investing in technological advancements in weather detection and forecasting, as well as upgrades to equipment and infrastructure, can help the industry adapt to some of the impacts of climate change in the longer term.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document is distributed by HSBC Bank (China) Company Limited, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank (Taiwan) Limited, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (200801006421 (807705-X)), The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank Middle East Limited, HSBC UK Bank plc, HSBC Bank plc, Jersey Branch, and HSBC Bank plc, Guernsey Branch, HSBC Private Bank (Suisse) SA, HSBC Private Bank (Suisse) SA DIFC Branch, HSBC Private Bank Suisse SA, South Africa Representative Office, HSBC Financial Services (Lebanon) SAL, HSBC Private banking (Luxembourg) SA, HSBC FinTech Services (Shanghai) Company Limited and The Hongkong and Shanghai Banking Corporation Limited and HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group (collectively, the “Distributors”) to their respective clients. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice. HBAP and the Distributors are not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HBAP and the Distributors give no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document. This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You should not use or rely on this document in making any investment decision. HBAP and the Distributors are not responsible for such use or reliance by you. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document. You should not reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to any jurisdiction where its distribution is unlawful.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/business. However, the Bank disclaims any guaranty on the management or operation performance of the trust business.

The following statement is only applicable to by HSBC Bank Australia with regard to how the publication is distributed to its customers: This document is distributed by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL/ACL 232595 (HBAU). HBAP has a Sydney Branch ARBN 117 925 970 AFSL 301737.The statements contained in this document are general in nature and do not constitute investment research or a recommendation, or a statement of opinion (financial product advice) to buy or sell investments. This document has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the document you should consider its appropriateness to you, with regard to your objectives, financial situation, and needs.

The following statement is only applicable to HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group with regard to how the publication is distributed to its customers: This publication is distributed by Wealth Insights of HSBC México, and its objective is for informational purposes only and should not be interpreted as an offer or invitation to buy or sell any security related to financial instruments, investments or other financial product. This communication is not intended to contain an exhaustive description of the considerations that may be important in making a decision to make any change and/or modification to any product, and what is contained or reflected in this report does not constitute, and is not intended to constitute, nor should it be construed as advice, investment advice or a recommendation, offer or solicitation to buy or sell any service, product, security, merchandise, currency or any other asset.

Receiving parties should not consider this document as a substitute for their own judgment. The past performance of the securities or financial instruments mentioned herein is not necessarily indicative of future results. All information, as well as prices indicated, are subject to change without prior notice; Wealth Insights of HSBC Mexico is not obliged to update or keep it current or to give any notification in the event that the information presented here undergoes any update or change. The securities and investment products described herein may not be suitable for sale in all jurisdictions or may not be suitable for some categories of investors.

The information contained in this communication is derived from a variety of sources deemed reliable; however, its accuracy or completeness cannot be guaranteed. HSBC México will not be responsible for any loss or damage of any kind that may arise from transmission errors, inaccuracies, omissions, changes in market factors or conditions, or any other circumstance beyond the control of HSBC. Different HSBC legal entities may carry out distribution of Wealth Insights internationally in accordance with local regulatory requirements. HSBC specifically prohibits the redistribution of this material and is not responsible for any actions that third parties may take to and/or with it.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

The material contained in this document is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HSBC India does not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Investments are subject to market risk, read all investment related documents carefully.

Important information about ESG and Sustainable Investing

In broad terms "ESG and sustainable investing" products include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors to varying degrees. Certain instruments we classify as ESG or sustainable investing products may be in the process of changing to deliver sustainability outcomes. There is no guarantee that ESG and Sustainable investing products will produce returns similar to those which don’t have any ESG or sustainable characteristics. ESG and Sustainable investing products may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for, ESG and Sustainable investing or the impact of ESG and Sustainable investing products. ESG and Sustainable investing and related impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the ESG / sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of ESG / sustainability impact will be achieved. ESG and Sustainable investing is an evolving area and new regulations and coverage are being developed which will affect how investments can be categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.

When we allocate an HSBC ESG and Sustainable Investing (SI) classification: HSBC ESG Enhanced, HSBC Thematic or HSBC Impact to an investment product, this does not mean that all individual underlying holdings in the investment product or portfolio individually qualify for the classification. Similarly, when we classify an equity or fixed income under an HSBC ESG Enhanced, HSBC Thematic or HSBC Impact category, this does not mean that the underlying issuer’s activities are fully aligned with the relevant ESG product or sustainable characteristics attributable to the classification. As such, an SI classification does not mean that all underlying holdings in a fund meet the relevant sustainable investment criteria. Not all investments, portfolios or services are eligible to be classified under our ESG and SI classifications. This may be because there is insufficient information available or because a particular investment product does not meet HSBC’s SI classifications criteria.

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. For more information visit www.hsbc.com/sustainability